Over the last year and a half, we have seen base rates* rise 100-fold to levels not seen in 15 years. The accelerated pace of Federal Reserve tightening, in an effort to combat inflationary pressures, has made the cost of borrowing for owners of commercial real estate dramatically higher and has negatively affected the cash flow profiles associated with those assets. This blog post will illustrate how the sharp rise in interest rates, as well as other drivers, has impacted the commercial real estate market and the opportunities that exist for well-capitalized investors.

*Base rate defined as the Secured Overnight Financing Rate (SOFR)

In 2020, monetary and fiscal policy efforts to stave off possible recession during the COVID-19 pandemic resulted in record amounts of stimulus, monetary easing, and a decrease in short-term interest rates to near zero. It did not take long, however, for these highly accommodative policies to apply upward pressure on prices resulting in headline inflation peaking at 9.1% in June 20221. In response, the Federal Reserve made a sharp reversal in policy and began to aggressively raise the benchmark federal funds rate from 1.21% in June 2022 to 5.12% as of July 20232.

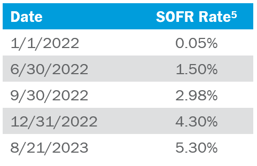

Through the Fed’s monetary tightening efforts, inflation gradually improved and is currently hovering around 3%3. The tradeoff, however, is higher overall interest rates, with SOFR currently at 5.3%4. The chart below illustrates the change in SOFR over the last year and a half:

A higher base rate has several significant implications, especially for owners of real estate assets who purchased at lower capitalization rates and have upcoming loan maturities in the next several months.

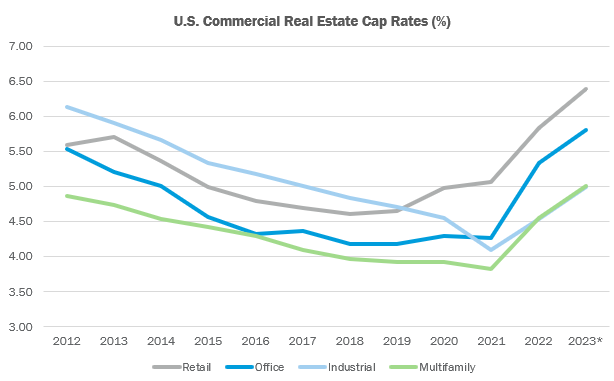

A key metric used to analyze commercial real estate is the capitalization rate (cap rate). Cap rates have generally moved in tandem with interest rates and are a function of the net operating income and corresponding value of the underlying real estate asset. Furthermore, cap rates and real estate asset values have an inverse relationship when all other factors are held equal. When cap rates go down, asset values go up, and when cap rates go up, values go down. Over the last two years, commercial real estate cap rates, across all sectors, have increased and thus have put downward pressure on asset values.

Source: CBRE Group, Real Capital Analytics, December 2022

(*) Indicates forecast

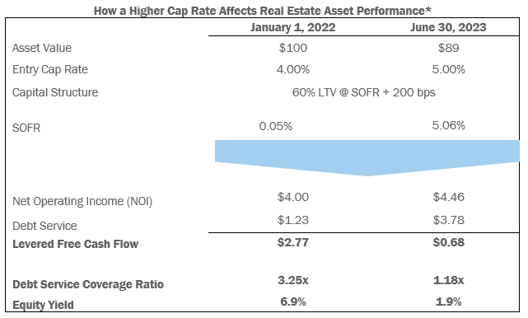

Core multifamily assets, while still displaying relatively resilient performance driven by continued low vacancy rates and inventory shortages, have seen increases in cap rates. Rising interest rates are the main culprit as cash flow profiles have deteriorated due to the higher cost of debt. Below is a hypothetical example illustrating the before and after effects of rising interest rates on commercial real estate asset values and their associated cash flow profile:

*The example is provided for illustration of the impact of the rate change on asset value and cash flow. The information is not intended to be accurate or complete, nor to be construed as a forecast of real estate dynamics in the future. Real estate prices are affected by many variables outside of change in interest rates.

Assuming a cap rate increase from 4% to 5% for a multifamily property, while growing rental income by 11.4%6 (the average national rental growth rate over the past 12 months), the underlying property’s value would decline by 11%, from $100 to $89.

Now, let us also assume that the loan is a floating rate loan—which tends to be the case for many commercial real estate loans—meaning the interest rate charged on the loan adjusts as the base rate changes. As shown above, base rates have gone from near zero to north of 5%. This increase clearly translates to a higher level of debt service, which eats away at the underlying asset’s free cash flow profile and lowers the debt service coverage to just above 1x compared to over 3x a year and a half earlier.

Commercial real estate owners currently face a number of challenges, including diminished asset values, reduced cash flow (NOI) of the underlying asset driven by higher interest rates, reduced rental growth rates, and an increase in debt servicing costs.

As a result, lenders are requiring borrowers to support transactions with higher levels of equity as a prerequisite for refinancing an existing loan. Thus, gone are the days of being approved for a standard commercial real estate loan at 60-65% loan-to-value (LTV). This issue is further exacerbated by regional banks playing a smaller role in the loan market, a direct result of the regional banking crisis that took place during the first half of this year. At one point, regional banks made up approximately 70% of commercial real estate loans issued by U.S. banks.

As this financing conduit has dried up, borrowers will face difficulty refinancing their existing loans and will either be forced sellers, forced to find alternative financing options (likely with private lenders at much higher rates), or inject fresh capital themselves to pay down the debt (cash-in refinancing).

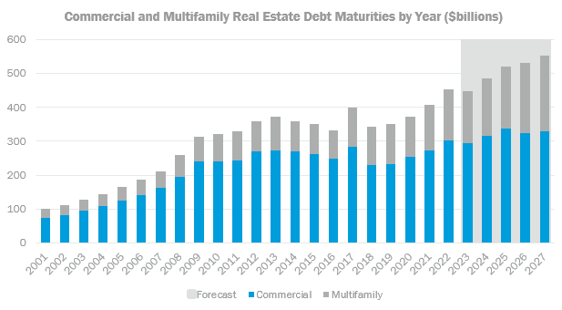

The commercial real estate market has experienced a dramatic shift over the last two years, driven primarily by the material rise in interest rates over a relatively short period of time. Commercial real estate investors who sought to capitalize on recent demographic trends and cheap financing now face significant loan maturities over the next few years. According to Preqin and Affinius, there will be close to $1.5 trillion in commercial mortgage loan maturities between 2023 and 2025. However, it will prove difficult for many borrowers to refinance at these higher lending rates (as illustrated above) and the lower levels of debt that lenders are prepared to extend (reduced LTV ratios). Borrowers will likely have to make the difficult decision of whether to inject additional equity which, in some cases, may not make financial sense, or seek out high-cost capital providers.

Source: Preqin, Affinius Capital Research

Based on the structural and fundamental issues highlighted, we believe there could be the potential for significant distress and dislocation in the real estate and adjacent lending market. This in turn should present an abundant opportunity set for real estate investors and private lenders. Institutional real estate investment managers are currently fundraising to take advantage of the growing opportunity set to purchase overleveraged properties at attractive pricing, as well as provide rescue financing.

Disclosures

This post is written purely for informational purposes as a thought piece on the dynamics of the impact of interest rate change on the dynamics of real estate valuation. This is not to be construed as a solicitation or recommendation to purchase any security or to engage Canterbury’s services. Canterbury will assess a client’s objectives, goals, investment horizon and risk tolerances prior to making any investment recommendation. Any performance shown is for illustrative purposes only and does not include key information such as fees, liquidity and other important information that needs to be taken into consideration prior to making a particular investment. Canterbury shall not be liable for inaccuracy, the inauthenticity of information, errors, or omission of the content contained herein. Regardless of the cause of such inaccuracy, the inauthenticity, error, or omission of the content, in no event shall Canterbury be liable for related or consequential damages.

Sources:

This article was written by Christian Cruz, Senior Associate, Investment Research. Mr. Cruz is a member of Canterbury’s Research Group, responsible for sourcing, due diligence, and evaluating private equity managers. He also serves on Canterbury’s Global Equity and Private Equity Manager Research Committee. Prior to joining Canterbury, Mr. Cruz served as a research associate with Beacon Economics and as an associate with ICF International, assigned as a contract economist for the Department of Homeland Security. Mr. Cruz holds a Master of Business Administration from the University of California, Irvine. He earned a Master of Arts in economics from California State University, Fullerton, and a Bachelor of Arts in business management economics from the University of California, Santa Cruz.