Active management has faced challenges over the recent decade. In particular, the U.S. large-cap space has proven to be a difficult area for active managers to add value. Apple, Microsoft, Amazon, and Google have dominated returns and make up a significant weight in the Russell 1000 Index. The companies’ combined $6.2 trillion market cap is now greater than the GDP of every country in the world except for the U.S. and China. An index so driven by a select few companies may be more appropriate for indexing.

A more favorable area for active management that is less dependent on the success of a few large companies has been the small-cap space. The addition of a U.S. small-cap active equity manager has shown to benefit an investment portfolio over longer periods by providing strong absolute returns, positive excess returns net of fees over respective benchmarks, and improved diversification.

Although larger companies have been in favor over the recent decade, smaller companies have the upper hand over multiple decades. The annualized return for small caps, mid caps, and large caps1 from 1972 through 2019 was 11.7%, 12.0%, and 10.4%, respectively. The benefits of higher returns come with added risk. As shown Exhibit B, the volatility of returns, as represented by standard deviation, increases further down the market cap spectrum.

Exhibit A (Left). Source: Portfolio Visualizer as of December 31, 2019

Exhibit B (Right). Source: Morningstar, 15-year period ending December 31, 2019

Small-cap stocks also managed to outperform large-cap stocks in the economic recovery periods following the last five recessions as defined by the National Bureau of Economic Research2. Of course, every recession is unique, including the current COVID-related recession. However, history has shown that small-cap stocks tend to be favored following a downturn.

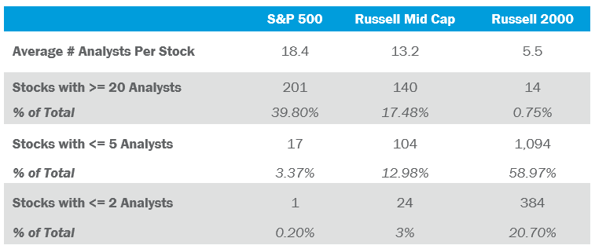

According to Diamond Hill’s May 2020 investment letter, Small Cap Stocks: Selective Opportunity, indexing in small-caps, although less expensive, exposes investors to the almost 40% of companies in the Russell 2000 Index that do not earn money. Active managers can navigate away from these more concerning areas of the index and focus on higher-quality companies. Managers also benefit from the higher dispersion of returns among small companies and the limited analyst coverage of each company. Exhibit C shows that five or fewer analysts cover the majority of companies in the Russell 2000. Only 13% of mid-cap companies and 3.4% of the companies in the S&P 500 in the U.S. have the same limited coverage. These inefficiencies in the space can improve the chances of finding undervalued stocks and active managers can capitalize on this opportunity.

Sell-Side Analyst Coverage

Exhibit C. Source: FactSet Research Systems as of April 30, 2020

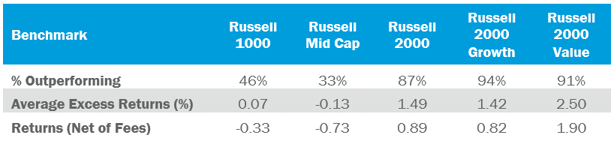

According to data from Morningstar, when measured on a rolling-three year basis over a 15-year period from 2005 to 2019, the average small-cap manager outperformed the Russell 2000 benchmark 86.7% of the time with an average excess return of 1.5% gross of fees. Over the same time frame and on the same rolling period basis, mid-cap and large-cap managers underperformed their respective benchmarks the majority of the time and experienced average excess returns of -0.1% and 0.1% gross of fees, respectively. Exhibit D reveals that after factoring in management fees, small-cap active management has paid off, whereas mid- and large-cap managers fell short.

Exhibit D. Source: Morningstar as of December 31, 2019

Pairing a small-cap manager with a large-cap manager can improve the diversification of the U.S. equity sleeve of a portfolio. Large-cap managers tend to use the appropriate style-specific Russell 1000 index as their benchmark and small-cap managers use one of Russell 2000 style-specific indices. The pairing offers exposure to essentially 98% of the U.S. equity market with little to no overlap. On the other hand, pairing a SMID-cap manager with a large-cap manager may be less optimal. SMID managers use the Russell 2500 benchmark, which is a combination of both the Russell 2000 and the bottom 500 companies of the Russell 1000. The SMID-cap and large-cap managers may invest in the same 500 companies in the Russell 1000, which would lead to increased overlap and reduced diversification in the portfolio.

Small-cap company exposure can also help offset some of the geopolitical issues, trade concerns, and currency headwinds that face some larger companies, who tend to have greater earnings and revenue exposure to overseas markets. Approximately 38% of the revenue generated by companies in the Russell 1000 index is from markets outside the United States. For companies in the Russell 2000, about 20% of the revenue comes from abroad. Because of the greater U.S. focus, smaller companies are less vulnerable to issues related to geopolitics and economic conditions in non-U.S. markets.

Over the long term, small-cap active managers have proven to be much more consistent and effective than both mid-cap and large-cap active managers in generating incremental returns over their respective benchmarks. For investors constructing their U.S. equity portfolio, consider the enhanced returns and diversification potential that active management can provide in the small-cap space.