Bitcoin (“BTC”) has recently captured significant interest from investors and capital allocators as it has matured from its humble beginnings post the Great Financial Crisis. In less than 16 years, bitcoin’s market capitalization has grown from zero to over $1 trillion. With the SEC’s approval of bitcoin ETFs in January 2024, institutional investors, advisors, and investment consultants may begin to take a closer look at the asset as the regulatory landscape becomes clearer.

This paper is designed to provide investment consultants, advisors, and capital allocators with deeper insights into bitcoin’s strategic role within a diversified portfolio. Specifically, we will explore the following topics:

Defining Bitcoin

Rather than going into detail on the technical specifics of bitcoin’s underlying technology, which are explained in readily available resources, including the bitcoin whitepaper (https://bitcoin.org/bitcoin.pdf), we will provide a high-level overview. Bitcoin is an open-source, decentralized software protocol that enables the movement of economic value without the need for intermediaries or external financial institutions managing the ledger. It operates independently of any central authority, individual, or entity.

Bitcoin emerged after the trials and errors of previous failed digital cash protocols, becoming the first cryptocurrency to solve the double-spend problem while maintaining decentralization. Double-spend is when someone attempts to use the same digital currency more than once. Banks and other traditional ledgers prevent this by verifying transactions through a centralized authority. Bitcoin satisfies the double spend problem through its decentralized network of nodes (computers running the bitcoin software) that verify and record each transaction. To-date, the bitcoin network has avoided hacking or corruption due to the combination of economic incentives and real-world costs, such as energy expenditure from the proof of work consensus algorithm.

Key elements of the Bitcoin protocol are as follows:

“Bitcoin” (capital “B”) refers to the network, while “bitcoin” (lowercase “b”) refers to the native digital currency used within the network. The Bitcoin protocol operates independently from any other system, recognizing only its native digital currency, bitcoin, which has a fixed supply capped at 21 million units. Supply grows on a fixed schedule and will not reach the 21 million limit until the year 2140.

The reward for mining a new block is halved approximately every four years, an event known as the “Halving.” Initially, 50 BTC were awarded per block, which was reduced to 25 BTC after the first Halving. The current reward is 3.125 BTC, with new blocks produced roughly every 10 minutes. To ensure consistency of the 10-minute average, the protocol incorporates a “difficulty adjustment,” which modifies the difficulty of mining a new block based on the network’s total computing power (“hash rate”). As mining power increases, the difficulty rises, and as mining power decreases, the difficulty lowers. This automatic process ensures that block production remains predictable and stable. As a result, bitcoin issuance is not impacted by fluctuations in compute power.

What Gives Bitcoin Its Value?

Market participants have debated whether bitcoin should be classified as property, money, or something in between. Bitcoin has demonstrated itself to be a non-sovereign, decentralized savings technology that has increased in purchasing power since its inception. Bitcoin’s absolute scarcity is governed by its code and economic incentives, making it more predictable compared to inflationary fiat currencies that debase over time.

Exhibit A illustrates the growth of a dollar invested in bitcoin, and Exhibit B displays the cost of eggs over time, priced in satoshis, the smallest unit of a bitcoin (1 bitcoin=100,000,000 satoshis).

Bitcoin has increased in value due to its provable, absolute scarcity and censorship-resistant transactions secured by a decentralized network. These qualities, along with following characteristics, contribute to bitcoin’s value and position it as a potentially strong form of collateral:

Bitcoin nodes are geographically distributed, making it extremely difficult for any single actor to censor or restrict transactions. Moreover, no single entity can control or debase it. This means no centralized actor can alter the protocol or change the supply schedule unless there is consensus among the majority of dispersed nodes running the bitcoin software. While the 21-million cap on bitcoin’s supply could theoretically be changed, doing so would be highly disadvantageous for holders, as it would dilute the value of the existing supply.

Holding more bitcoin does not grant additional influence or security over the network. The Proof of Work consensus mechanism, which requires expending real-world energy to mine the next block and earn a reward (i.e., bitcoin + transaction fees), ensures an equitable process, open to any participant who is willing to invest and expend real resources. Miners must expend more computational power (i.e., energy) if they want to reap more rewards from the protocol. Therefore, the likelihood of earning more bitcoin is not dependent on the amount of bitcoin one holds.

Bitcoin is immutable because transactions cannot be reversed or altered by a centralized entity, reducing counterparty risk, and ensuring final settlement. Counterparty risk is minimized further since bitcoin is a bearer asset, allowing users to hold it directly without needing third party verification of ownership. The reduction in counterparty risk enhances bitcoin’s value as collateral, as it minimizes reliance on third parties.

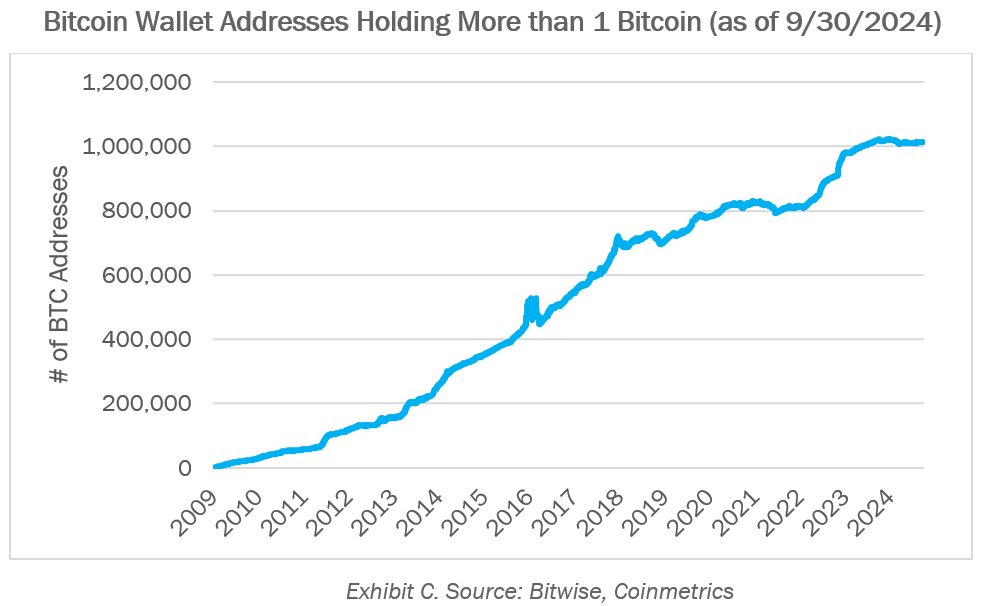

Finally, bitcoin’s value is tied to its longevity and exponential growth over the past 15 years. Similar to other emerging technologies that experience network effects, bitcoin’s value grows with its adoption. The graph below shows the number of wallet addresses holding one bitcoin or more. As the price has increased, so has the number of participants holding significant value in bitcoin.

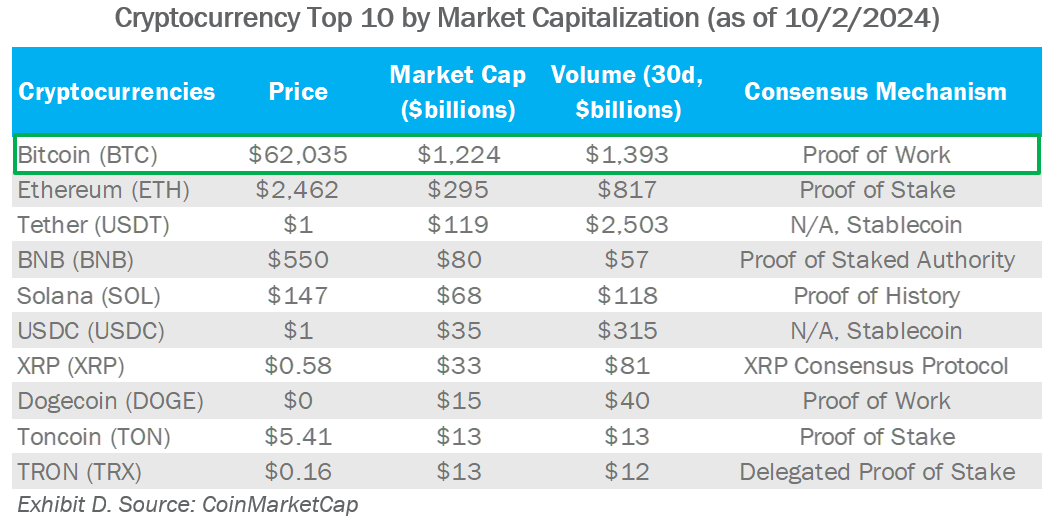

Bitcoin also has a “first mover” advantage, having proven to be the most decentralized and liquid digital asset compared to other cryptocurrencies to-date.

While a detailed comparison of cryptocurrencies is beyond the scope of this paper, bitcoin’s monetary premium and store-of-value narratives are unlikely to be challenged by competing digital assets due to the following factors:

Additionally, bitcoin’s fixed supply, censorship resistance, immutable transactions, and strong network effects further distinguish it from other cryptocurrencies.

Historical Performance

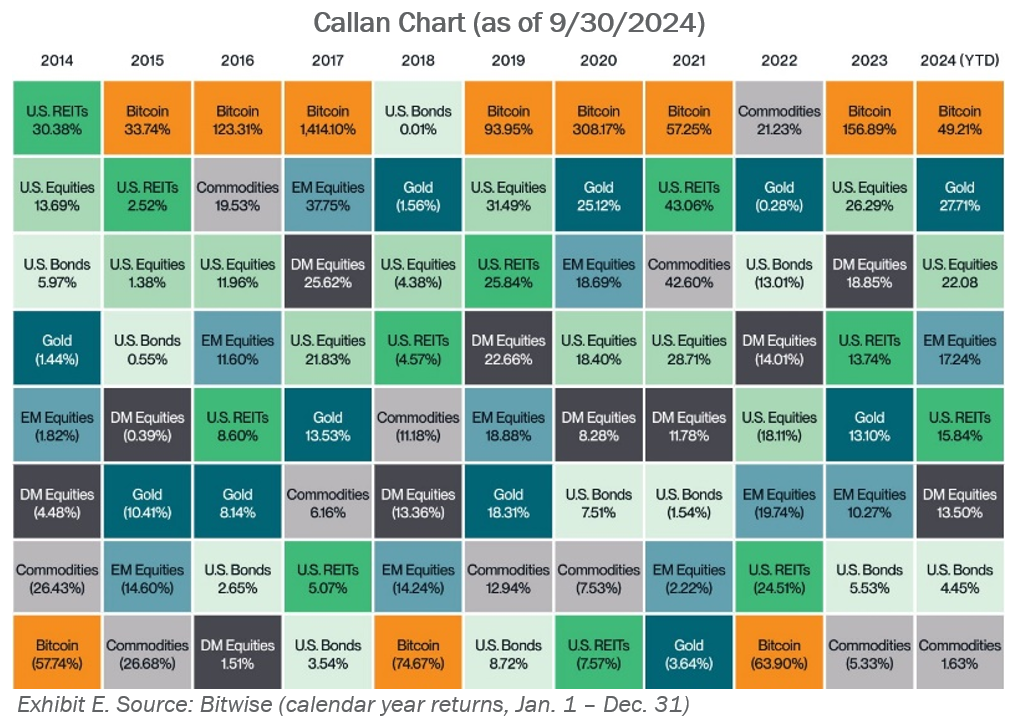

For the purposes of this paper, we will exclude bitcoin’s first ~5 years of performance due to its low adoption rate, limited availability to market participants, and disproportionately high returns during that period. Returns on the following pages are calculated daily (365-day periods). Over the past 10 years (as of 9/30/2024), bitcoin has generated annualized returns of approximately 66% with an annualized standard deviation of 69%, resulting in an annualized Sharpe Ratio of 1.28, a measure of risk-adjusted return. While bitcoin has experienced severe volatility and drawdowns (i.e., 2014, 2018, and 2022), it has outperformed every other prominent asset class in 8 of the past 11 calendar years (including 2024).

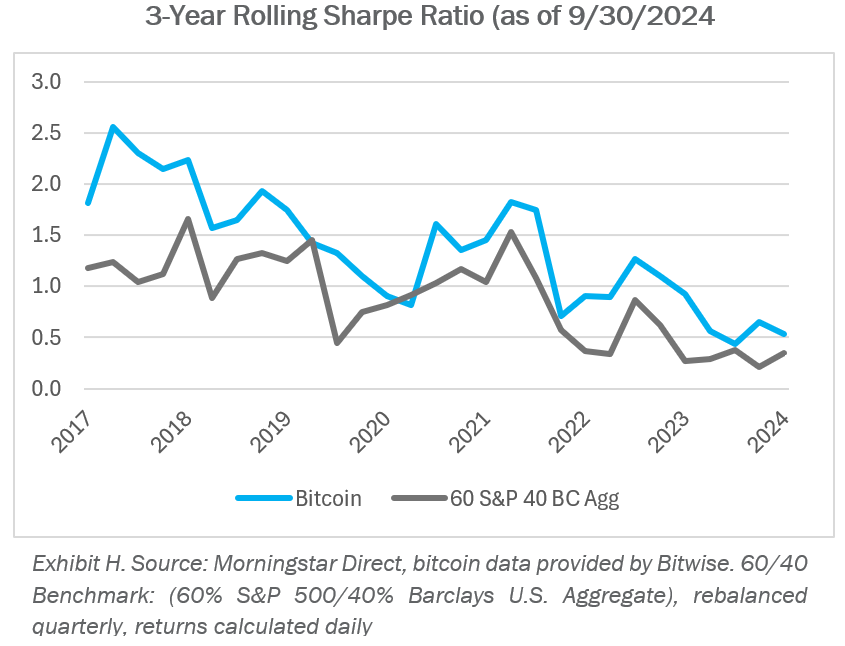

How does bitcoin’s high returns and high volatility compare with a traditional investment portfolio? For purposes of this exercise, we will define a traditional portfolio as 60% equity (S&P 500), 40% fixed income (Barclays U.S. Aggregate), (“60/40”). On a rolling 3-Year basis, both returns and standard deviation over the past decade are significantly higher when compared to a 60/40 portfolio.

Bitcoin’s standard deviation, consistently between 60-100%, may cause hesitation for investors considering the asset. While bitcoin’s volatility is much higher than that of a 60/40 portfolio, this gap has gradually narrowed, with volatility approaching 50% over the last several years. Despite its higher volatility, bitcoin has outperformed a 60/40 portfolio on a risk-adjusted basis.

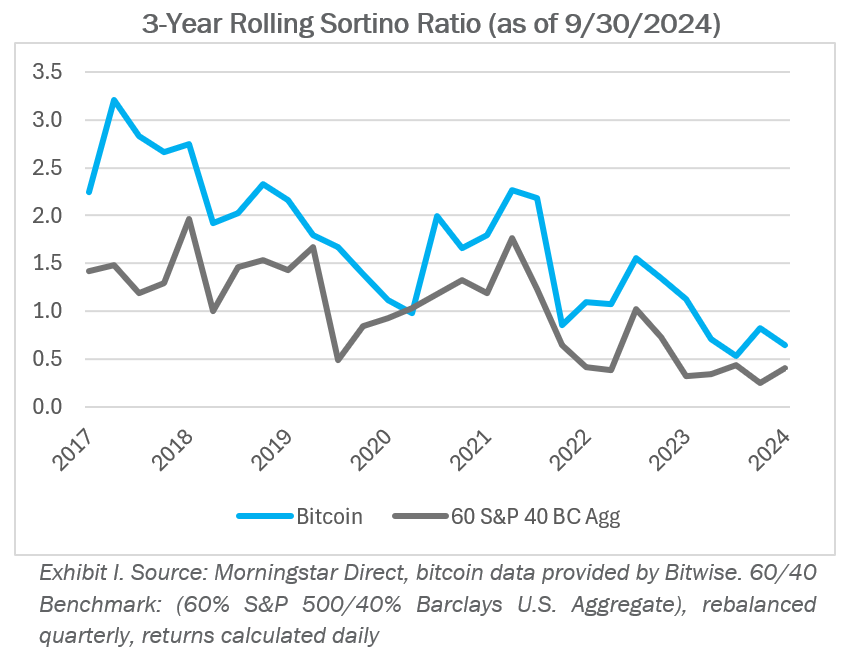

Even though bitcoin has a history of large drawdowns, the asset has consistently delivered superior downside risk-adjusted returns compared to a 60/40 portfolio. The Sortino Ratio, which measures returns relative to downside risk, isolates negative volatility, and demonstrates bitcoin’s ability to outperform during periods of market stress.

To further illustrate, bitcoin’s return distribution over the past 10 years has been skewed to the right, indicating more periods of outsized positive performance than negative. The histogram chart below compares bitcoin’s return distribution to that of a 60/40 portfolio.

At the expense of its higher volatility, bitcoin has historically compared favorably to a traditional 60/40 portfolio in terms of risk-adjusted return, downside deviation, and positive asymmetry. Moreover, as bitcoin has matured, these metrics have gradually converged with those of a 60/40 portfolio.

Comparing Bitcoin to Other Traditional Assets

Does bitcoin resemble or mimic traditional investments? Given its dual narratives as both a store of value and an emerging technology, bitcoin is often compared to gold and technology stocks.

Gold, while having merit as a commodity with real-world use cases, derives a substantial portion of its worth from being a monetary premium asset – one that holds or accrues value beyond its utility. Bitcoin shares similar features with gold, such as scarcity (limited supply), fungibility (each unit is interchangeable), and durability (preservation of purchasing power).

However, bitcoin differs from gold in many respects.

While gold and bitcoin share similarities, they are fundamentally different.

Bitcoin is also perceived as an emerging technology. Does this mean it functions merely as a leveraged technology bet or venture capital (“VC”) investment?

Bitcoin’s return and volatility characteristics do resemble those of a leveraged technology play. When compared to the Nasdaq 100, using the QQQ ETF as a proxy, bitcoin generated a similar Sharpe Ratio (i.e., risk-adjusted return). However, bitcoin exhibited higher return, greater standard deviation, and more severe maximum drawdowns (peak-to-trough losses) than technology stocks.

Over the past 10 years, bitcoin has delivered more than three times the return and volatility of technology stocks, with roughly 2.5 times the drawdown, exhibiting characteristics of leveraged tech. However, a deeper analysis reveals a more nuanced story.

Below are definitions and insights from these characteristics:

Adjusting for volatility provides further clarity. By constructing a portfolio with 20% bitcoin and 80% cash (using 3-month T-Bills as a proxy), the portfolio’s historical volatility aligns more closely with that of the QQQ. Additionally, bitcoin’s diversification benefits remain when compared against a traditional 60/40 portfolio.

Over the past 10 years, a portfolio consisting of 20% bitcoin and 80% cash, rebalanced quarterly, has outperformed both tech stocks and a traditional 60/40 portfolio on an absolute and risk-adjusted basis, while providing correlation benefits. Historically, bitcoin has provided performance qualities that diversify it from technology stocks.

Bitcoin’s Place in a Portfolio

Bitcoin’s inherent qualities and performance results distinguish it from traditional assets. It is neither a real asset nor simply a leveraged tech play, but perhaps something in between. Since bitcoin does not fit neatly into conventional asset class categories, where should it reside in a portfolio?

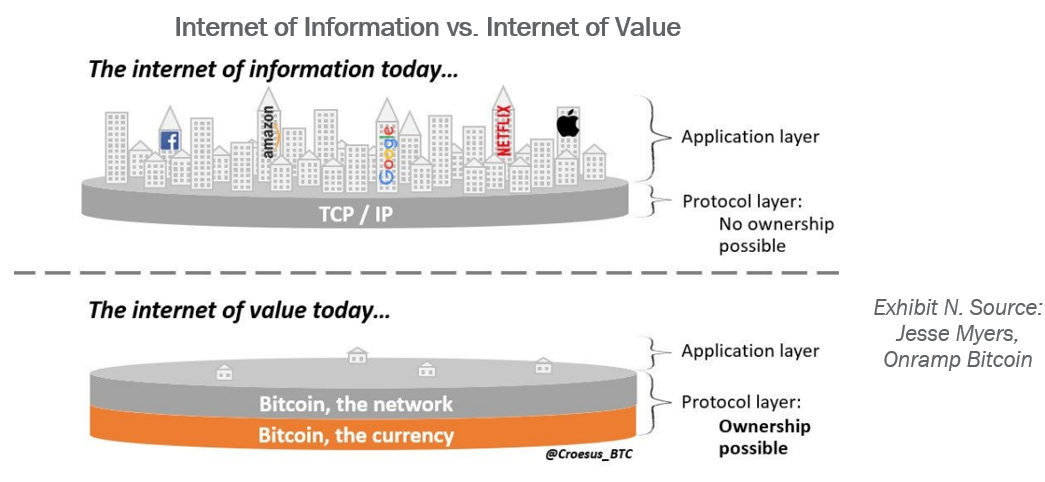

Bitcoin is not equivalent to a single stock or security; rather, it is a digital protocol where the native currency, bitcoin (lowercase “b”), is interdependent with the Bitcoin network (uppercase “B”) to facilitate transactions and settlements. A relevant investment framework should position bitcoin as an investable base layer protocol. An investment in bitcoin is analogous to how TCP/IP serves as the foundational layer for internet applications today.

As illustrated in the graph by Jesse Myers, it is now possible to own a stake in the base layer of an “internet of value” through bitcoin. This was not feasible during the adoption cycle of the “internet of information,” where value accrued at the application layer (i.e., layer 2).

Given the context, how should asset allocators categorize bitcoin? The straightforward answer is that there is no simple classification, but this should not deter participating in the diversification benefits of the asset. Under traditional asset allocation bucketing categories, one could argue that bitcoin might be classified as a venture capital, technology, commodity, absolute return, or opportunistic investment.

Regardless of where bitcoin resides in a portfolio, its unique characteristics and performance patterns offer diversification benefits.

Hypothetical Performance Impact Based on Allocating and Rebalancing

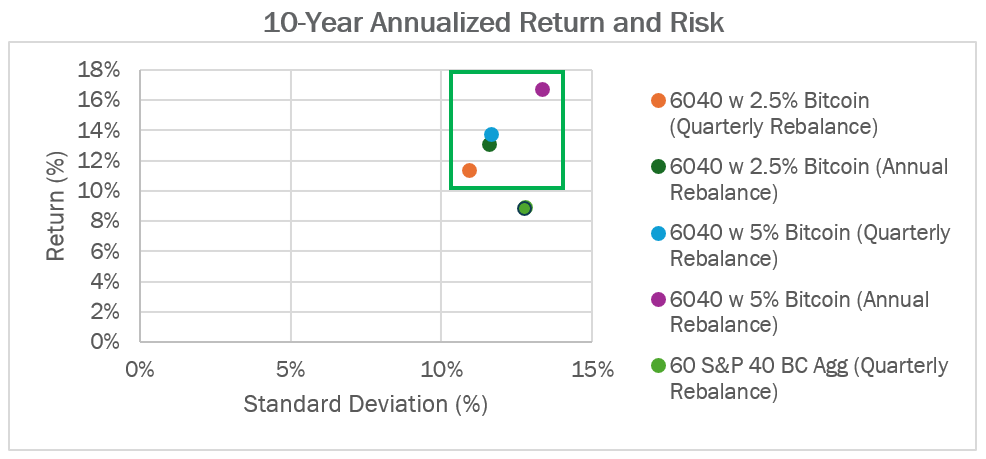

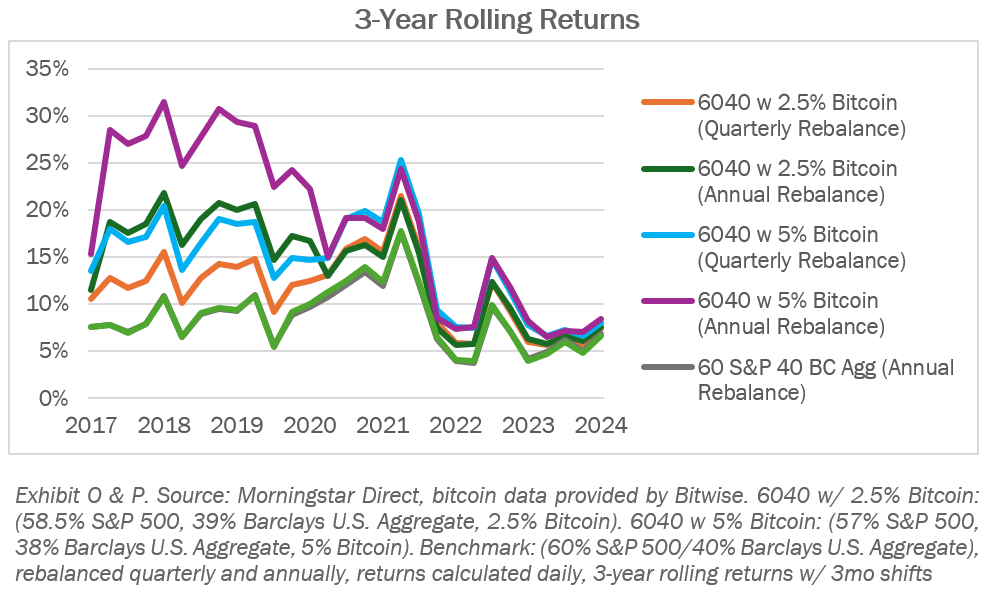

How does overall portfolio return and risk compare when incorporating different bitcoin allocations and rebalancing frequencies into a traditional 60/40 portfolio?

To keep the analysis straightforward, we will examine four distinct scenarios with small allocations to bitcoin:

Bitcoin exposure in all portfolios is funded by adjusting the 60/40 weighting. For example, a 2.5% bitcoin allocation is funded by reducing equities by 1.5% and bonds by 1.0%. Returns are calculated daily, and performance is presented over a 10-year period on both an annualized end point and 3-year rolling basis.

Key takeaways:

In all, rebalancing bitcoin exposure on a quarterly or annual basis would have improved historic risk-adjusted hypothetical returns across the entire portfolio.

Access and Custody of Bitcoin

There are multiple ways to access and hold bitcoin, each with its own merits and considerations. As mentioned earlier, bitcoin is a bearer asset, meaning that whoever holds it has direct ownership of the asset. Bitcoin can be purchased directly from a cryptocurrency exchange and either held on the exchange or transferred to a bitcoin wallet. A bitcoin wallet allows users to store, send, and receive bitcoin. It includes a private key (a secret cryptographic key that provides the owner access and control over their bitcoin), a public key (a public address where others can send bitcoin), and a wallet address (represented by a string of alphanumeric characters that can be shared to receive bitcoin).

Wallets store private keys, not the bitcoin itself; the keys grant access to the bitcoin on the blockchain. Users can send and receive bitcoin by creating and signing transactions. Wallets also display the total bitcoin balance owned by the user. Wallets can either be connected to the internet (hot wallet) or kept offline (cold wallet).

Additionally, custody can take the form of a multi-signature (multi-sig) approach, where, for example, 2 out of 3 keys are required to authorize a bitcoin transaction. Beyond direct ownership, in January 2024, the SEC approved bitcoin ETFs, allowing investors to gain exposure to bitcoin through a registered investment vehicle. Below are the benefits and drawbacks of these approaches.

Buy Bitcoin Directly, Custody on an Exchange

Buy Bitcoin Directly, Custody in a Hot Wallet

Buy Bitcoin Directly, Custody in a Cold Wallet

Buy Bitcoin Directly, Custody in a Multi-Signature Wallet

Buy a Bitcoin ETF

Ultimately, each bitcoin purchase and custody solution come with a set of trade-offs. Security, convenience, and accessibility are key factors to consider when choosing the appropriate buying and custody approach.

Potential Outlook From Others

As we discussed in the section “What Gives Bitcoin Its Value,” the asset has experienced significant growth in both value and adoption over its ~15-year history. While the future remains uncertain, comparing bitcoin’s market size to other investable assets highlights its potential for further adoption and growth relative to traditional investments.

While bitcoin’s market capitalization has grown by over $1 trillion, it is minuscule compared to real estate, bonds, equities, money, gold, art, and collectibles. As more investors recognize bitcoin as a non-sovereign, scarce store of value collateral, it is probable that global wealth will increasingly flow into the asset from traditional sources.

What factors might drive bitcoin adoption in the future? According to Michael Saylor, Executive Chairperson of MicroStrategy and a strong advocate for bitcoin, evolution in technology, regulation, and economics will serve as tailwinds for the asset. Key factors he identifies include:

Addressing the factors mentioned above could drive approval across a broader range of entities outside of the traditional investment community, including corporate treasuries (e.g., MicroStrategy, Block, Tesla) and nation states (e.g., El Salvador, Kingdom of Bhutan).

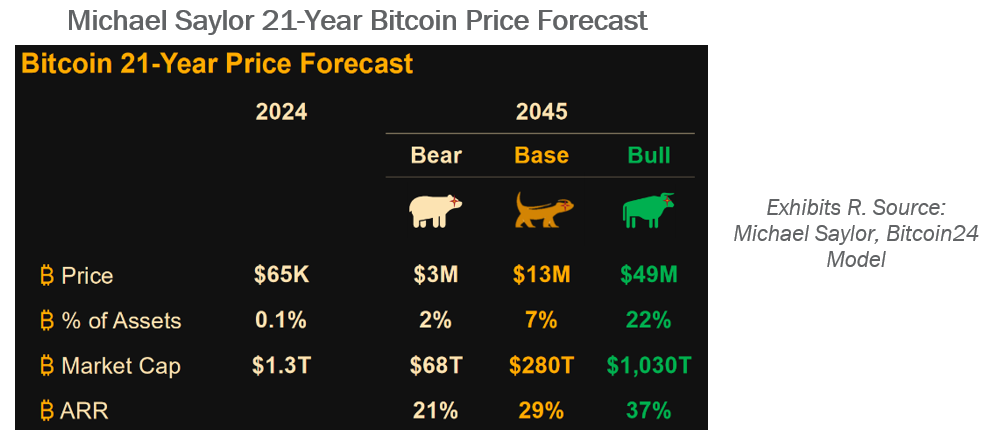

We will refrain from making our own price predictions, but Michael Saylor projects that bitcoin’s share of total investable assets could grow from 0.1% to 7% over the next 21 years.

The forecast’s base case projects that bitcoin could grows at an annualized rate of return (“ARR”) of 29%, resulting in a price of $13 million per bitcoin by the year 2045. In this scenario, Bitcoin’s position relative to other investable assets is shown on the next page.

The forecast assumes that total global asset value will increase from $900 trillion to $4,000 trillion, with bitcoin reaching a $280 trillion market capitalization. This growth may seem extreme, but bitcoin’s size would still be smaller than all global assets except gold and art.

Though we have explored bitcoin’s value proposition as a store of value, we have not discussed its potential as a medium of exchange. A common critique is that bitcoin is slower and supports fewer transactions compared to legacy payment providers and other cryptocurrencies. However, this is intentional, as bitcoin prioritizes decentralization and security over scalability. Layer 2 protocols, such as the Lightning Network, offer potential solutions by facilitating faster and easier micropayments, which eventually settle on the Bitcoin network (“Layer 1”). The growth and adoption of these Layer 2 solutions could further enhance bitcoin’s utility and may unlock additional value.

Conclusion

In this paper, we established a foundation for understanding bitcoin and evaluating its potential benefits in a diversified portfolio. Bitcoin’s unique qualities and uncorrelated historical return patterns offer differentiated exposure that traditional investments cannot easily replicate. While the future of its adoption and performance is uncertain, bitcoin’s stability and value will continue to be measured by the protocol’s ability to persistently enforce its fixed supply in a decentralized manner. No other investable asset can currently make that claim, which makes bitcoin a unique investment opportunity for investors.

The comments provided herein are a general overview of the characteristics of the Bitcoin protocol and do not constitute investment advice, are not predictive of any future development in the space, and do not represent an offer to sell or a solicitation to buy any security. Similarly, this information is not intended to provide specific advice, recommendations, or projected returns. Future returns may be higher or lower than the results portrayed in this presentation. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS, WHICH COULD VARY SUBSTANTIALLY. The scenario analysis provided is a hypothetical illustration of calculated performance and does not reflect the actual performance of any client portfolio. The information presented is for illustrative purposes only and does not constitute an exhaustive explanation of the investment process, investment strategies or risk management. Benchmarks and indices are presented herein for illustrative and comparative purposes only. The views presented herein represent good faith views of Canterbury Consulting as of the date of this communication and are subject to change as economic and market conditions dictate. The external sources cited for views and opinions reflect the perspectives of the source and do not necessarily reflect the views of Canterbury. Canterbury believes that these sources are reliable but can make no representation as to the accuracy of such sources or the adequacy and completeness of such information.

Certain financial information and figures may be considered forward looking statements, which can be identified by use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “project”, “estimate”, “target”, “continue”, “believe”, or the negatives thereof or other variations thereon or comparable terminology. Such forward looking statements do not, nor are they intended to, constitute a promise of actual results. Such information and forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from the financial information, projections and estimates included in this presentation. The investments discussed in this document may not be suitable for all investors. Before making an investment in any fund or account managed by Canterbury, its principals or its individual members, you should consult your legal, tax, and investment advisor to determine whether any such investment is suitable for you in light of your investment objectives and financial situation.