Short-term fixed income and money market funds presently provide attractive absolute yields compared to rates over the last 15 years. Consequently, investors are opting to reduce their duration exposure and allocate to cash-equivalent or near-maturity fixed income securities. While intriguing in the short run, there are risks not fully appreciated when assessing asset allocation for an established investment portfolio. This blog post will delve into the pros and cons of short versus long duration fixed income and evaluate unintended implications.

The Move to Short-Term Fixed Income

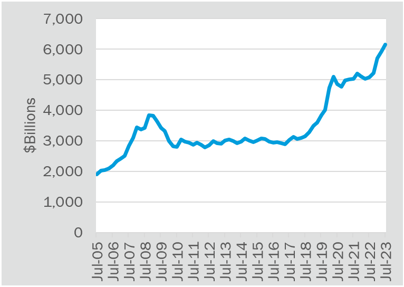

The Federal Reserve’s rate-hiking cycle over the past two years has resulted in the money market complex (funds of stable short-term fixed income securities consisting of treasury bills, commercial paper, & corporate bonds) growing to over $6.1 trillion in total size, the largest amount in history.

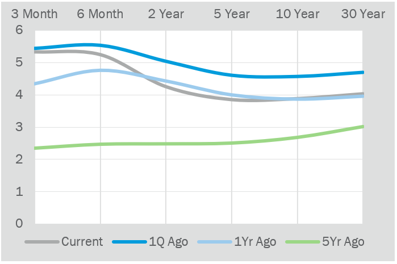

Demand stemmed from a combination of bank deposits as well as investors seeking the liquidity and safety of short duration securities. As the Federal Reserve raised the Fed Funds rate by more than 5%, the yield curve inverted due to the difference between short term and long-term growth and inflation expectations.

Money Fund Growth

Figure 1. Source: FRED St. Louis Fed. As of 6/30/2023

Why take on additional risk or extend duration when investors can potentially earn approximately 5% from near risk-free bonds, especially in the context of an inverted yield curve?

U.S. Treasury Yield Curve as of 12/31/2023 (%)

Figure 2. Source: Federal Reserve Economic Data, U.S. Treasury Department. As of 12/31/2023

Performance Impact

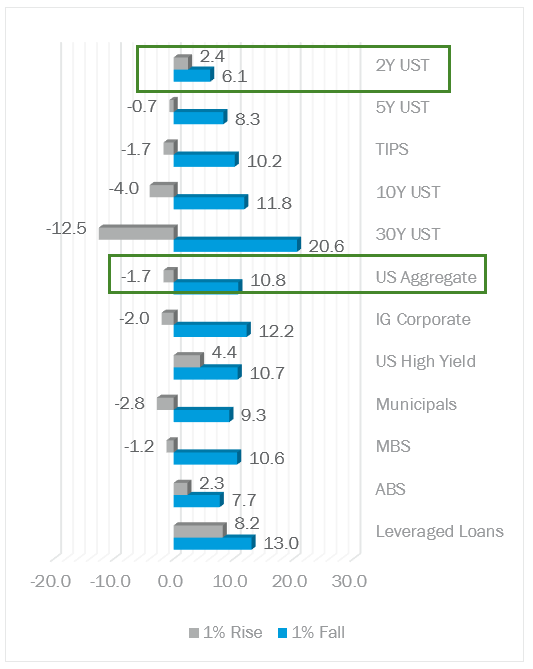

While it is true that investors can currently earn a 4-5% yield by holding near-term maturities, the total return in fixed income may vary once the yield curve normalizes. Cash-equivalent securities experience less price impact in a declining interest rate environment due to their short-term maturities and the subsequent reinvestment in bonds at a lower rate. For instance, if the Fed decided to cut interest rates by 1% tomorrow, money market funds would promptly adjust, offsetting 1% from the yield that investors initially perceived as part of their annualized return.

Conversely, price impact may apply a positive asymmetric effect on fixed income total returns, especially if duration is extended in the current rate environment.

Considering the level of current yields, a 1% decrease in interest rates has a more substantial impact on returns than a 1% increase in interest rates. Every incremental move higher in interest rates has less of an effect on outstanding bond prices given higher base rates relative to years prior. Moreover, long-duration fixed income presents an asymmetric potential for positive returns if interest rates were to decline.

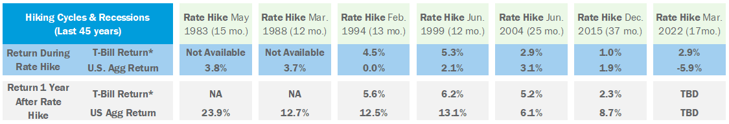

The Barclays U.S. Aggregate Bond index historically outperforms short-term bonds once the Fed shifts from rate hiking to rate cutting. The chart below compares the returns of Bloomberg U.S. Treasury Bills Index and the U.S. Aggregate during the rate-hiking cycle and the returns of both indices one year after the rate-hiking cycle concludes.

Total Return (%) Impact of a 1% Rise/Fall in Interest Rates (assumes a parallel shift in the yield curve)

Figure 3. Source: JP Morgan Guide to the Markets as of 12/31/2023

Barclays U.S. Aggregate versus Bloomberg U.S. Treasury Bills Performance

Figure 4: Source: Morningstar Direct. As of 12/31/2023

*Bloomberg U.S. Treasury Index used as a proxy for T-Bills

T-Bill returns performed better than the U.S. Aggregate during a rate hiking cycle, however U.S. Aggregate returns meaningfully outpaced T-Bill returns one year after the Fed Funds rate peaked.

Diversification Benefits

Intermediate-to-long duration fixed income provides positive diversification benefits during an economic downturn or recession. Investors tend to seek safety in long-dated government bonds during periods of financial stress. As interest rates decline, long duration bonds become advantageous due to their heightened sensitivity to rate changes. In times of economic stress, interest rates may decrease rapidly, favoring bonds with higher duration and greater interest rate sensitivity. Risk assets like equities typically experience selloffs, making long duration bonds more effective in providing diversification benefits compared to short duration bonds.

Conclusion

Timing the shift in interest rates and predicting changes to the yield curve is challenging. While it might be wise for investors to maintain short-dated fixed income or cash for liquidity purposes, executing tactical rotations between short and long-duration securities has proven to be difficult for asset allocation purposes. Although interest rates may remain elevated for an extended period, and , historical data indicates that exposure to longer-duration securities has provided diversification benefits for portfolios over the long run.

Sources:

[1] Source: FRED St. Louis Fed

[2] Source: Federal Reserve Economic Data, U.S. Treasury Department

[3] Source: JP Morgan Guide to the Markets

[4] Source: Morningstar Direct

Disclosures

Canterbury believes that the information contained herein is accurate and/or derived from sources which are reliable, but Canterbury does not warrant its accuracy or completeness. Canterbury has no obligation (express or implied) to update any or all of the information contained herein or to advise you of any changes. The drivers of fiscal and monetary policies as well as its effect on economic conditions are complex. The blogpost does not aim to provide accurate or complete description of its dynamics. To the extent any information herein constitutes "forward-looking statements" (which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "upside", "potential", "project", "estimate", "intend", "continue", "target", "pending" or "believe" or comparable terminology), please note that, due to various risks and uncertainties, actual events, results or performance may differ materially from those reflected or contemplated in such forward-looking statements. Any forward looking statements are for illustrative purposes only and are not to be relied upon as predictive of any specific economic or financial outcome.

Mr. Asmus is a shareholder and part of Canterbury’s Research Group. He is responsible for the sourcing, due diligence, and monitoring of public market investment managers. He serves as chair of Canterbury’s ESG, Fixed Income, and Real Assets Manager Research Committees, and vice chair of the Hedge Funds Committee. He also sits on the Capital Markets Committee. Mr. Asmus joined Canterbury in 2013 as an analyst serving institutional and taxable clients. Prior to Canterbury, Mr. Asmus was an institutional fixed income representative for Mutual Securities, LLC, where he provided fixed income solutions for county and city municipalities. Mr. Asmus graduated with a Bachelor of Arts from California State University, Fullerton, where he double majored in business administration, finance, and music performance, jazz studies. He is a CFA® charterholder and a Chartered Alternative Investment Analyst.