The pandemic of 2020 forced the hand of policymakers to take unprecedented measures to keep the economy afloat. The record levels of economic stimulus brought about fears regarding the potential demise of the U.S. dollar's global dominance. Three years later, digital currency activists and market participants continue to question the dominance of the U.S. dollar. The goal of this blog post is to provide a brief history lesson on the U.S. dollar, the reasons for its global dominance, and insights into the direction of its dominance going forward.

The U.S. dollar (USD) has been the world's dominant currency for more than 70 years, essentially since the Bretton Woods System was created in 1944. The Bretton Woods System required countries to peg their currency to the USD, which was, in turn, pegged to gold at the time. Bretton Woods came to an end in the 1970s when President Richard Nixon announced that the US would no longer peg the dollar to gold. Since the end of the Bretton Woods System, the USD has continued to be the most widely used currency around the globe and the largest reserve currency in the world.

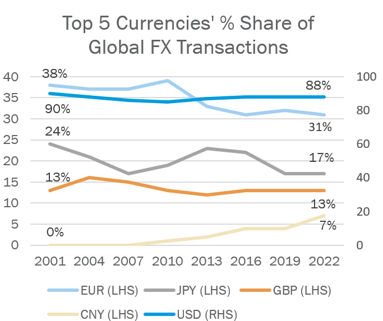

In 2022, global currency exchange trading volume was recorded at $7.5 trillion per day1. That is 30 times greater than daily world GDP according to the Bank of International Settlements. Out of all FX trades in 2022, the U.S. dollar was one side of the trade 88% of the time. Over a decade ago in 2010, global foreign exchange transactions totaled approximately $4 trillion per day, almost half of what it was in 2022. In 2010, the U.S. dollar was one side of the trade 87% of the time. The share of the U.S. dollar being one side of a currency trade has continued to be relatively stable at around 88% for over a decade.

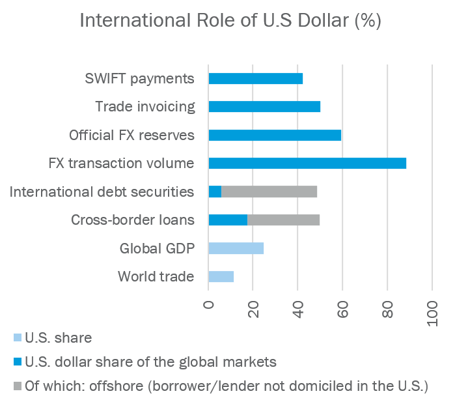

The USD's global dominance can be attributed to many factors. The size of the U.S. economy, the importance of the economy in international trade, the size, depth, and transparency of financial markets, and the credibility of the U.S. macroeconomic policies are some major factors that contribute to the USD's global dominance. The chart below helps illustrate just that.

Graph 1: Source: “Revisiting the International Role of the US Dollar,” Bafundi Maronoti. As of second quarter of 20222.

There are many factors that tend to be overlooked when considering the role of the U.S. dollar. One such factor is that approximately half of all debt securities and cross-border loans in global markets are denominated in USD, as shown in Graph 1. Out of all international debt securities issued in USD, 88% are issued by entities outside of the U.S. Another overlooked fact is the use of the USD as a vehicle currency. Non-U.S. dollar currency pairs are not widely available, so in order for a non-U.S. dollar currency to be exchanged for another non-U.S. dollar currency, the non-U.S. dollar would have to be exchanged for USD and then converted to the desired non-US dollar. Vehicle currency transactions are estimated to constitute 40% of global currency exchange volume3. In addition, approximately half of global trade is invoiced in USD according to the Federal Reserve4, despite the U.S. representing a small share of world trade as shown in Graph 1.

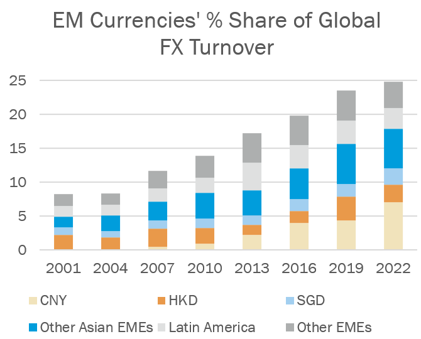

Over the past 20 years, the Euro has been the second most traded currency in the world, followed by the Japanese Yen and the British Pound. The Euro, Yen, and Pound have steadily lost market share over the past 20 years as emerging market (EM) countries have grown. The growth of EM countries has contributed to their currencies being traded more frequently over the years as they play a larger role in international markets. According to the International Monetary Fund (IMF), emerging market GDP was recently recorded (as of April 2023) at $45.1 trillion, compared to approximately $8 trillion 20 years ago5. Current U.S. GDP is approximately $26 trillion, up from approximately $11 trillion 20 years ago. Given that EM GDP has grown rapidly, it is no wonder why their currencies have been taking a larger market share in global FX transactions. The chart below helps illustrate the growing share of EM currencies in FX transactions over the years.

Graph 2: Source: Bank of International Settlements: BIS Quarterly Review December 20221

Alongside the growth of emerging market countries is the rise of the Chinese economy. Chinese GDP was approximately $2 trillion over 20 years ago and now stands at approximately $19 trillion, making it the second largest economy globally behind the U.S.5 Given the rapid rise of the Chinese economy, the Chinese Yuan (CNY) has made a large impact on global currency trading volume. The Chinese currency being one side of a trade represented less than 1% of global exchange volume 20 years ago and now makes up 7%. That makes the Yuan the 5th most traded currency in the world, following the British Pound. The chart below helps illustrate the top 5 most traded currencies and their relative market share in global FX transactions over the years.

Graph 3: Source: Bank of International Settlements: BIS Quarterly Review December 20221

There is no doubt that several global economies are rising to power and gaining more influence around the world than in prior years. As shown in Graph 3, the Euro, Yen, and Pound have lost market share in global FX transactions, while the USD has remained relatively stable. While the U.S. has been spending and issuing debt at record levels, which may raise concerns about the USD's global dominance, there are many factors that set the U.S. apart from other economies. The strength of the domestic economy, the economy’s impact on global trade, the credibility of macroeconomic policies, and the size, depth, and transparency of financial markets are all major factors that distinguish the U.S. from other economies. It is reasonable to expect that the USD may slowly lose some of its dominance over time, but the USD plays a large role in international debt markets, global GDP, FX transaction volume, trade volumes, and SWIFT payments (a messaging network used by banks to securely make transactions worldwide) as shown in Graph 1. Additionally, there are no major alternative currencies that can play the same role that the USD does, which is why the dominance of the USD is likely to stay for many years to come, despite the claims of digital currency activists.

Sources:

As a member of Canterbury’s Research Group, Mr. Escalante is responsible for the sourcing, due diligence, and monitoring of public market managers. He serves as vice chair of Canterbury's Real Assets Committee and serves on the Fixed Income Manager Research Committee. Mr. Escalante holds a Bachelor of Arts in business administration-finance and a minor in economics from California State University, Fullerton. While at Fullerton, he was a member of Titan Capital Management (formerly Applied Security Analysis Program) and vice president of the Student Managed Investment Fund.