The long/short equity hedge fund landscape has undergone significant changes since the start of the rate hike cycle in March 2022. In the decade leading up to this cycle, the market was characterized by low volatility, minimal inflation, and reduced interest rates. These conditions presented numerous challenges for hedge fund managers. However, with the recent elevation of interest rates amid heightened market uncertainty, these challenges may transform into advantages. The primary focus of this blog is to delve into one of these favorable developments: the impact of higher yields on the short rebate.

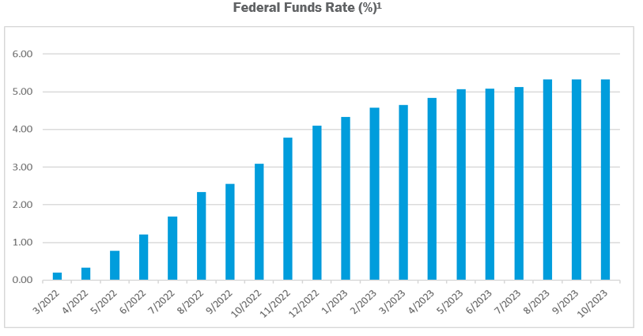

Long/short equity hedge funds were at a disadvantage in the market environment that prevailed in the 10 years leading up to March 2022. This period was characterized by low interest rates, minimal inflation, and subdued volatility. Market growth during this time was primarily driven by multiple expansion, indicative of sentiment-driven growth and the near zero interest rate regime. Such conditions made security selection challenging, as stocks tended to move in unison, and all but eliminated positive returns from the short rebate. However, since March 2022, there has been a notable shift. Interest rates have risen by over 500 basis points due to the Federal Reserve's tighter monetary policy. This shift has expanded the opportunity set for hedge funds, enabling them to more effectively identify companies for inclusion in both their short and long portfolios.

Hedge funds are typically better suited to perform in turbulent markets where uncertainty highlights the importance of fundamentals in stock selection. This is crucial for the performance of both the long and short positions in a fund. Furthermore, the increase in the Federal Funds Rate has provided hedge funds with additional benefits, including increased earnings from the short rebate and higher yields on their excess cash.

To fully grasp the concept of the short rebate, it's essential to understand the dynamics of short positions. This involves a manager borrowing securities from lenders who own them, while providing collateral, usually cash or a comparable security such as a US treasury, to the lender. This collateral acts as a safety net in case of default. As this collateral typically accrues interest at the Federal Funds Rate, the lender must pay back both the accrued interest and the collateral to the manager when the securities are returned. On the other hand, the manager is responsible for paying a fee (typically 25 – 50 basis points2, though it can be substantially more for highly sought after securities) on the borrowed stock and reimburse any dividends received to the lender. Simplistically, the short rebate can be calculated as the Fed Funds Rate minus the dividend yield and the spread.

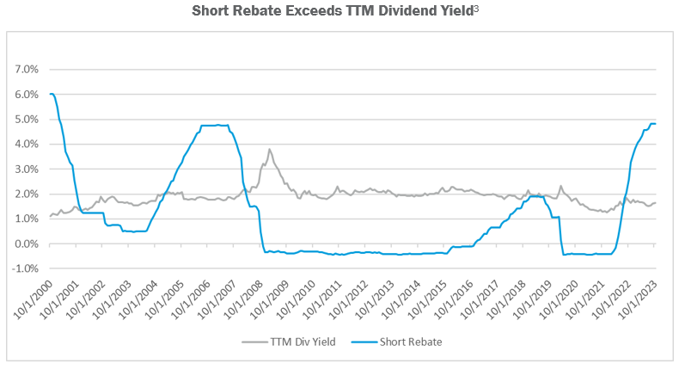

Hedge funds can benefit from the short rebate in scenarios where the Fed Funds Rate surpasses both the dividend yield and the spread charged by the lender. The accompanying chart illustrates the S&P 500’s dividend yield in comparison to the short rebate. Notably, the short rebate has been negative since the onset of the Great Financial Crisis in 2008, a period characterized by historically low interest rates, until it turned positive in August 2022. This long period of low rates increased costs for hedge fund managers, adversely affecting their performance. With the recent changes, managers with equity exposure below 100% in their long book can now also earn a materially higher yield on their idle cash, potentially enhancing their portfolio's overall return.

For a hedge fund to earn a cash rebate on its long book, its gross long equity exposure needs to be under 100%. If the exposure exceeds this threshold, the fund will not have surplus cash to invest in interest bearing securities or funds (including money market funds). For instance, if a hedge fund maintains a 75% gross long exposure, it could potentially earn over a 5% yield[1] on 25% of its Net Asset Value (NAV) (the idle cash in the long book).

Furthermore, as outlined in the previous section, the fund can generate a positive short rebate. Suppose it has a 50% short exposure and then earns a short rebate on this portion of the NAV. After accounting for the spread (fee) and reimbursing any dividends on the short book, and adding the cash yield and dividends from the long book, the fund can earn a positive yield on a significant portion of its NAV. More specifically, the fund will earn close to the risk-free rate on 75% of its NAV, combining the benefits from both the idle cash and short rebates.

In the past decade and beyond, hedge funds have encountered numerous challenges, but the current market environment presents new opportunities. Unlike the past 15 years, where market growth was predominantly driven by multiple expansion and near zero interest rates, hedge funds now have the chance to enhance returns through earning a short rebate and higher yields on excess cash, as illustrated in figure 2. Additionally, the current market dynamics offer increased opportunities for hedge funds to identify dislocations, allowing them to effectively utilize both their long and short books to generate greater alpha.

It's important to note that a significant portion of hedge funds typically maintain highly concentrated portfolios, which are less diversified than their long-only counterparts, and can vary the fund’s long and short exposures materially. Consequently, there is a wide range in performance among managers with similar strategies and exposure levels. Investors considering long/short equity hedge funds should exercise caution and choose a manager whose return profile and risk appetite align with their own. This decision should be underpinned by a comprehensive due diligence process.

Sources:

As a member of Canterbury’s Research Group, Mr. Sorenson is responsible for aiding in the evaluation, due diligence, and monitoring of private capital and public market investment managers. Prior to joining Canterbury full-time, Mr. Sorenson completed Canterbury’s investment research internship program. Mr. Sorenson holds a Bachelor of Science in finance from California State University, Long Beach. While at California State University, Long Beach, he gained hands-on experience in security analysis and portfolio management as part of a one-year honors program called Beach Investment Group.