On Wednesday, July 31st, the Federal Reserve cut interest rates for the first time since the Great Financial Crisis. The 25 basis point cut was effectively an insurance policy to help quell concerns over the possibility of an economic slowdown, even as the U.S. experiences solid growth. We will discuss the reasons and the future implications of the Fed’s accommodative pivot, but first: how did we get here?

In less than a year, the Fed’s guidance on monetary policy shifted from a stance that was restrictive (hawkish) to one that is now accommodative (dovish). Shortly after the Fed hiked interest rates by 25 basis points in September, Chairman Jerome Powell insinuated that the neutral rate, the equilibrium rate that supports a balanced economy, was higher than the then current 2.00%–2.25% rate:

“The really extremely accommodative low interest rates that we needed when the economy was quite weak, we don’t need those anymore. They’re not appropriate anymore […] Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral […] We may go past neutral, but we’re a long way from neutral at this point, probably.”

—Jerome Powell, October 3, 20181

Over the following months, the stock market sold off as investors worried about a pullback in global growth as well as the trade uncertainty between the U.S. and China. The Fed continued with another 25 basis point rate hike on December 19th, which took the range to 2.25%–2.50%. The central bank communicated that they would be more data-dependent moving forward, however, Powell’s comments regarding balance sheet normalization was inferred to be a tighter-than-expected policy path. The messaging subsequently spooked an already volatile market:

“So we thought carefully about this, on how to normalize policy, and came to the view that we would effectively have the balance sheet runoff on automatic pilot and use monetary policy, rate policy, to adjust to incoming data. I think that the runoff of the balance sheet has been smooth and has served its purpose. And I don’t see us changing that.”

— Jerome Powell, December 19, 20182

Two weeks later, Chairman Powell delivered a speech with a more dovish tone which ultimately led to a stock market rally:

“We’re listening carefully with — sensitivity to the message that the markets are sending and we’ll be taking those downside risks into account as we make policy going forward.”

— Jerome Powell, January 4, 20193

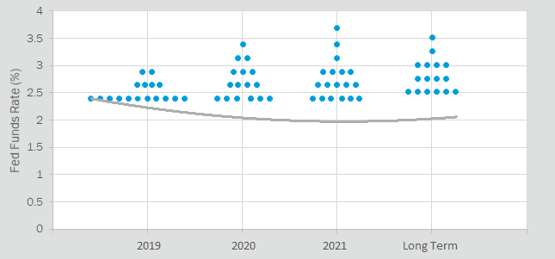

Since those comments, the Fed has moved more in line with the market’s accommodative view, which is most evident by the Federal Open Market Committee’s (FOMC’s) “Dot Plots.” The Dot Plots represent each FOMC member’s view on the future path of the Fed Funds Rate:

FOMC Meeting – March 2019

Exhibit A. Source: Bloomberg

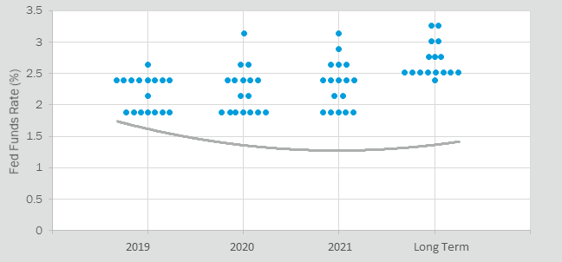

FOMC Meeting – June 2019

Exhibit B. Source: Bloomberg

The blue dots represent each FOMC member’s rate prediction while the gray line illustrates the market’s rate prediction. While the market has consistently anticipated lower interest rates relative to those of the FOMC, both estimates shifted meaningfully lower in the first half of 2019. The following move signaled that a rate cut was probable for the July meeting.

Given the previous backdrop, the question from markets was not whether the Fed would cut — but by how much? The Fed ultimately decided to cut rates by 25 basis points while ending their balance sheet roll off two months earlier than expected. Even though the committee was constructive on current economic activity and the strong labor market, the lowering of the benchmark rate to 2.00%–2.25% was primarily driven by low inflation expectations, future global uncertainties, and the questioned sustainability of the ongoing U.S. economic recovery. The Fed reiterated that they will be data-dependent and would not follow a preset schedule for monetary policy. The market initially perceived the guidance as somewhat hawkish since an aggressive cutting cycle was not announced.

Implications from the recent decision can result in a wide range of outcomes and has led to a polarizing range of opinions from market pundits, economists, and money managers. The fixed income managers we speak with on a regular basis are no different. One bond manager stated that the Fed made a policy mistake by hiking rates four times in 2018 and got ahead of the market. The manager believes that a monetary policy pivot was necessary given nonexistent inflationary pressures and low interest rates from other developed economies and across the globe, and expect the U.S. to continue experiencing modest growth as long as inflation stays close to 2%.

On the other end of the spectrum, another bond manager believes that the Fed’s renewed accommodative stance is creating a dangerous moral hazard by factoring in the health of financial markets into their decision. The Fed, the manager argues, is effectively signaling to the market that participants can take investment risk with no consequences or downside (i.e. the Fed put). Moreover, the manager believes the Fed may not have enough policy tools to protect the economy in the next downturn. The U.S. has rarely before seen expansionary monetary policy as stock and bond markets move to all-time highs.

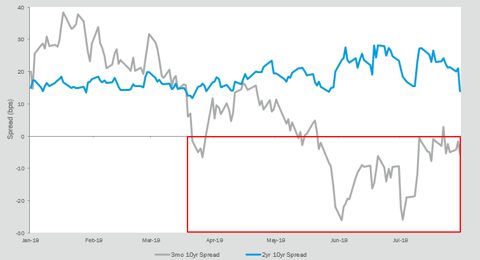

Most managers agree that the Fed is now following the market rather than the other way around. Long gone are the days when the market intently listened to a Fed Chair’s every word to help decipher clues on the future direction of the economy. The Fed seems to be taking cues from the market, which can be witnessed by the shape of the yield curve and the spread between short term and long term rates:

Inverted Yield Curve: Historical Spreads Between Short & Long-Dated Treasurys

Exhibit C. Source: Bloomberg

While the difference between the 2-year Treasury and the 10-year Treasury has stayed positive year-to-date, the difference between the 3-month T-Bill and the 10-year Treasury has been negative over the last several months. The market is signaling that more accommodation is needed to stave off a potential downturn and to spur further growth.

The Fed followed through with their rate cut, but many believe that a “mid-cycle adjustment” is not an aggressive enough stance. It goes without saying that the Fed finds itself in a difficult situation of balancing economic data with the views of the market.

1 Cox, Jeff. Powell says we’re ‘a long way’ from neutral on interest rates, indicating more hikes are coming. (CNBC, Oct. 3, 2018.)

2 Transcript of Chairman Powell’s Press Conference. (Federal Reserve, Dec. 19, 2018.)

3 Domm, Patti. Fed chief Powell gave the markets the message they wanted. (CNBC, Jan. 4, 2019.)