In nature, fish tend to swim in schools to avoid getting eaten by predators. Yet in investing, "going with the flow" can eat into your portfolio's gains. It can be helpful to review fund flows data, especially in times of distress. Here are three lessons about investor behavior learned from recent fund flows data.

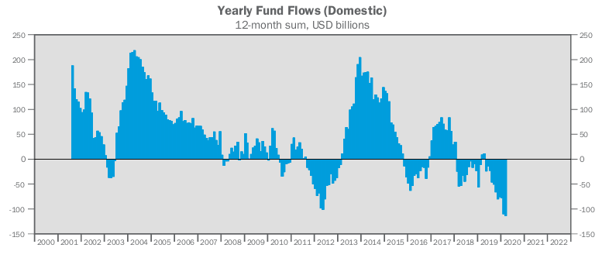

U.S. equity funds follow a predictable pattern of greed and fear. The largest fund inflows since the turn of the millennium occurred in 2004 and 2014. What do these years have in common? They took place after the market when gangbusters. In 2003, the S&P 500 increased by 29%. In 2013, the S&P 500 gained an even more impressive 32%. Both times, investors gobbled up equity funds in the following year. These unsustainably high gains were followed by more modest returns.

Conversely, the largest fund outflows occurred in 2012 and 2020. What happened before those years? In 2011, the S&P 500 fell into bear market territory (down over 20%) after Standard & Poor’s downgraded America's credit rating. In 2020, the COVID-19 pandemic sparked a stock market freefall in the first quarter, with the S&P 500 falling around 20%. In both cases, markets quickly recovered. Markets ended the year roughly flat in 2011. As of the time of this writing in 2020, the S&P 500 has retraced roughly half of its losses for the year. Although markets eventually recovered, the same cannot be said for investors who panicked and sold out of their equity funds at the bottom.

Exhibit A. Source: Yardeni Research, Inc.’s U.S. Mutual Funds Monthly Statistics Including Equity Mutual Funds and ETFs (April 29, 2020)

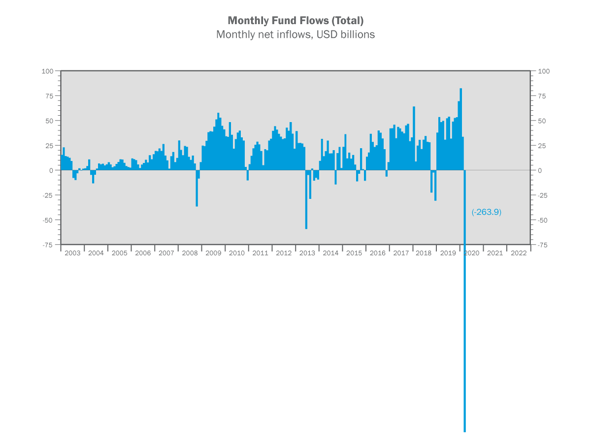

Bond fund flows tell an even more extreme version of this story. Exhibit B illustrates the epic meltdowns in bond fund history. In 2008, we had the Great Financial Crisis that threatened global stability. Then, in 2013, there was the “Taper Tantrum” after the Federal Reserve threatened the new normal of low interest rates. Finally, in 2020, the coronavirus crisis came and threatened our health and safety. Each of these events caused a mass exodus in bond funds. The most recent bout of panic selling is literally off-the-charts. Yet in each case, flows normalized after just a few months.

When bond outflows suddenly spike, bond managers are forced to liquidate their holdings, creating a brief but potentially rewarding opportunity. Think of it as a department store (remember those?) going out of business and being forced to offer its goods for pennies on the dollar.

Within a month of the COVID-19 pandemic, dozens of hedge fund managers launched temporary opportunistic funds to take advantage of the discounts available. Those who are best prepared to participate in these offerings may be able to benefit from this limited-time event. If history is a guide, the time window will be short.

Exhibit B. Source: Yardeni Research, Inc.’s U.S. Mutual Funds Monthly Statistics Including Bond Mutual Funds and ETFs (April 29, 2020)

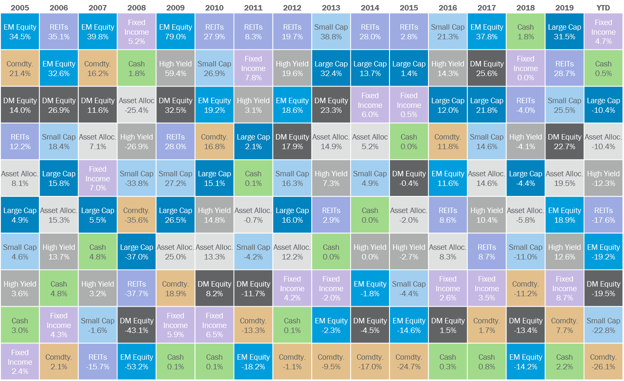

Besides being an aesthetically pleasing tapestry, Exhibit C also teaches us to value diversification. As opposed to the predictable cycles of fund flows, actual return data is much more random. This implies that when the crowds funnel into or out of an asset class to chase performance, they are acting on emotion, not rationality. They are being predictably irrational.

Even for the most seasoned of global macroeconomic investors, it is difficult to obtain a batting average much north of 0.500. This is because the world is a very complex system with more variables than can properly be accounted for. Just when you think your model captures every possible scenario —boom— a once-in-a-century virus arrives and disintegrates your portfolio. Having a well-balanced diversified portfolio can ensure that one’s eggs are not all in the wrong basket at the wrong time.

Exhibit C. Source: J.P. Morgan Asset Management’s Guide to the Markets: U.S. 2Q 2020 (March 31, 2020)

As investing sage Warren Buffet once said, “Only when the tide goes out do you discover who’s been swimming naked.” Even though going with the (fund) flows might feel safe, it is often better to go against (or at least ignore) them. By avoiding the traps of greed and fear, being opportunistic, and staying diversified, we may increase our chances of being able to metaphorically stand proudly once the tide goes out.