Last summer, we wrote about the FANGMAN (Facebook, Amazon, Netflix, Google, Microsoft, Apple, and NVIDIA) stocks and their incredible run in the stock market: Beware of FANGMAN. We wondered whether these popular stocks had gotten too expensive. These sizzling stocks have since cooled off. Are they good investments today?

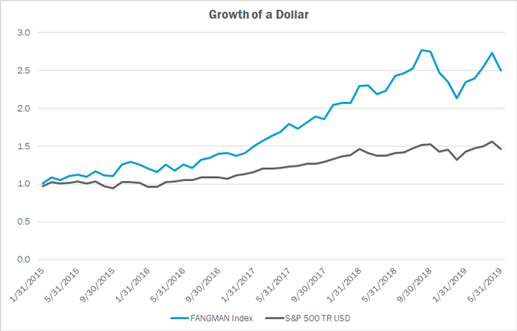

A year ago, the average P/E (price-to-earnings) ratio of the FANGMAN stocks was 69. As a refresher, the P/E ratio measures the relationship between a company’s stock price and its earnings per share. Think of it as the price you are paying for each dollar of a company’s annual earnings if you buy its stock. Since our last article was published, the FANGMAN index (a market capitalization-weighted average of these seven companies) is down 9.8% as of May 31, 2019. Meanwhile, the S&P 500 is only down 3.7%. From the time the article was written, the index suffered a max drawdown of 23%, which occurred from October through December. According to money managers that we follow, investors sold out of these names amid the market decline because they were among the most highly appreciated stocks. Over the first few months of 2019, the market has stabilized and these stocks have recovered from their lows.

Exhibit A. Source: Morningstar Direct

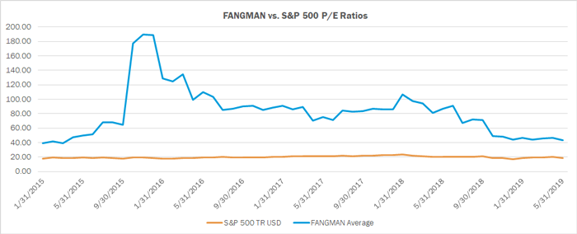

Even after the recovery, FANGMAN is now trading at a much more reasonable valuation. The group’s average P/E ratio is down to 43.3 as of May 31, 2019. This is as low as the P/E ratio has been since 2015, before FANGMAN’s run of impressive outperformance. Today, the companies are worth, as measured by their stock prices, roughly two and a half times as much as they were at the end of 2014, yet they still have a similar P/E ratio. This means that performance has been driven primarily by earnings growth. Recall in our definition of the P/E ratio above, if a stock’s price increases in the same proportion as earnings increase, then the ratio remains the same.

Exhibit B. Source: Morningstar Direct

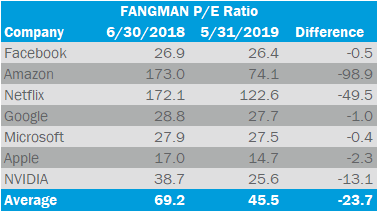

If we look at each individual stock, we find that some of the FANGMAN stocks are very cheap, while others remain expensive. One company, Apple, has a P/E ratio that is lower than the S&P 500’s. Facebook, Google, Microsoft, and NVIDIA are all moderately priced. Amazon and Netflix stick out as being expensive based on the P/E ratio. To value managers (money managers who generally focus on stocks with low P/E ratios), Apple, Google, and Facebook have become more enticing. Some of them have even purchased these companies once thought of as high growth stocks.

Exhibit C. Source: Morningstar Direct

Are the FANGMAN stocks good investments today? On the whole, they are not as expensive as they were nine months ago in September 2018, though some of the names look like better bargains than the others. It seems that recently, their performance has been driven by growing earnings rather than by multiple expansion (a term that is used to describe when stock prices go up without a corresponding increase in earnings). Thus, from a valuation perspective, they are less expensive today than they were a year ago.

However, can these companies continue to grow at the same torrid pace as they did in the past decade? Below are each of the companies past five years earnings growth rates compared to analysts estimates for the next five years, as of June 2019. Please note that the estimates represent the consensus estimates of sell-side analysts:

Exhibit D. Source: Yahoo! Finance

According to the analysts, of these seven businesses, only Google is expected to grow earnings at a (slightly) higher rate than it has in the past. Google, Facebook, Microsoft, and Apple, a group that includes two of the original “FANG” stocks, seem to possess the combination of reasonable valuations and growth expectations. It’s no surprise that many value-oriented as well as GARP (“Growth at a Reasonable Price”) money managers have been recently gravitating towards these stocks.

If there is a takeaway from this, it is that yesterday’s high-flying growth stocks can become today’s value stocks. As legendary value investor Warren Buffett once put it, “Price is what you pay, value is what you get.”