If you had to select investment managers and the only data you had available was their past three years of performance, how would you make your selection?

To most of us, when asked to select an investment manager according to only their past three years of performance, choosing the best-performing managers makes the most sense. However, research suggests that the counter-intuitive strategy of picking the biggest losers may actually yield the better performance.

Managers and strategies who have recently outperformed tend to hold more expensive assets, while managers who have recently underperformed tend to hold cheaper assets. Thus, the practice of “three-and-out” (firing a manager after three years of underperformance) can end up costing investors. The cost is further amplified if that underperforming manager is then replaced by a top-performing one.

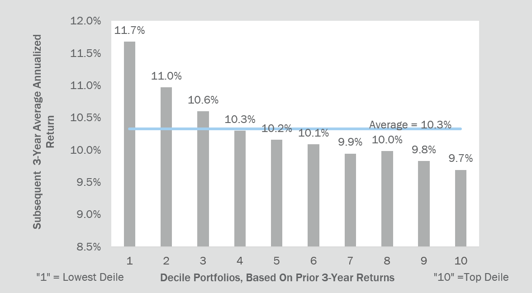

In their 2015 research paper, “Timing Poorly: A Guide to Generating Poor Returns While Investing in Successful Strategies,” Jason Hsu, Brett W. Myers, and Ryan Whitby found that the average mutual fund investor earns 2% less than the mutual funds in which they invest. Perhaps this performance-chasing behavior explains why, as coincidentally, 2% is the gap in performance between selecting the worst-performing funds and the best-performing funds, according to a recent study by Research Affiliates (Exhibit A).

Average Mutual Fund Subsequent 3-Year Performance

Sorted by Prior 3-Year Returns, U.S. Long-Only Equity Funds (Jan. 1990 – Dec. 2016)

Exhibit A. Source: Research Affiliates

Despite data indicating that we are better off choosing previous losers and selling winners, there are investors who continue to chase past performance. How can we ensure that we do not fall into this trap?

1. Concentrate on the cause of underperformance

Is the manager’s style simply out of favor or has the manager made out-of-character bets that have failed? If a manager’s style is out of favor but they have the discipline to stick to it, this can make the strategy a bounce-back candidate. On the other hand, if the manager’s underperformance is combined with style drift, such as a value manager buying growth stocks, this is often a sell signal.

In our experience, managers with long, successful track records tend to stick to their style. This results in long-term outperformance punctuated by brief periods of underperformance.

2. Reorient towards rolling returns

Most performance exhibits show trailing returns: year-to-date, one-year, three-year, five-year, etc. What do all of these have in common? These exhibits show recent periods. This standard of looking at performance emphasizes more recent numbers by including them more often than past numbers. As humans, we are already biased towards more recent events because they are easier to recall. Although trailing returns can be helpful, they tend to exacerbate that tendency.

We recommend looking at rolling three-year returns over time to get a less-biased sense of a manager’s long-term track record.

3) Focus on fundamentals

For a value manager, important metrics include price-to-earnings, price-to-book, and dividend yield. If underperformance has caused a portfolio to be cheaper, this may set it up to outperform in the future. For a growth manager, we focus on earnings growth, revenue growth, and profit margins. If these fundamental characteristics are improving even as the portfolio underperforms, this can also lead to outperformance.

The key is to look at the fundamentals of the underlying holdings and whether they are attractive or not, rather than just looking at recent performance.

The human instinct to chase what has worked and avoid what has not may have helped our ancestors survive, but it can be deadly to our modern-day portfolio profits. While it is unwise to completely abandon past performance, we recommend supplementing it with the practices above: concentrating on the causes of underperformance, reorienting towards rolling returns, and focusing on fundamentals. These practices can help us make better decisions than the “average mutual fund investor,” which can hopefully lead to increased chances of improved returns.